Welcome to Clickpay, the online payment platform that is revolutionizing the way individuals and businesses make payments. Our goal is to simplify the process of online transactions, making it easier and more convenient for everyone involved. With Clickpay, you can say goodbye to the hassle of cash or checks and embrace the simplicity of making payments with just a few clicks.

Whether you’re paying bills or making online purchases, Clickpay provides a secure and convenient solution. Our platform allows you to use your credit card to make payments, ensuring that your transactions are safe and protected. Say goodbye to the worries of sharing sensitive payment information online.

But convenience is just one part of the Clickpay experience. We also offer a user-friendly interface that makes navigating the platform a breeze. With Clickpay, you can set up your account, link your credit card, and start making payments in no time. It’s that simple!

Join the millions of users who have already discovered the benefits of Clickpay. Say goodbye to the hassle of traditional payment methods and embrace the convenience of online payments. From bill payments to online shopping, Clickpay is here to simplify your life.

Key Takeaways:

- Clickpay simplifies online payments by providing a secure and convenient platform.

- Users can make payments using their credit cards, eliminating the need for cash or checks.

- Clickpay offers a user-friendly interface that makes setting up and using the platform a breeze.

- Join millions of users and simplify your life with Clickpay’s convenient online payment solution.

What is Clickpay and How It’s Revolutionizing Payments

Clickpay is an online payment platform that is revolutionizing the way people make payments online. It provides a convenient and secure payment solution for individuals and businesses alike. With Clickpay, users can easily and quickly make online payments using their credit cards, eliminating the need for traditional payment methods like cash or checks.

The Basics of Clickpay

Clickpay is a comprehensive payment platform that offers a user-friendly interface and a seamless payment experience. It allows users to make payments with just a few clicks, providing convenience and efficiency. With Clickpay, users can securely store their credit card information, making future transactions even easier.

One of the main advantages of Clickpay is its versatility. It can be used for various types of online payments, including bill payments, e-commerce purchases, and subscriptions. This makes Clickpay a versatile and flexible payment solution for individuals and businesses.

Why Clickpay Is Gaining Popularity

Clickpay is gaining popularity due to several factors that set it apart from other payment platforms. First, its user-friendly interface makes it accessible to users of all levels of technical expertise. The streamlined checkout process saves time for users and provides convenience.

Additionally, Clickpay prioritizes the security of its users’ payment information. It employs advanced encryption technology to ensure that sensitive data is protected. This commitment to security provides peace of mind for users, making Clickpay a trusted platform for online payments.

Furthermore, Clickpay has built a vast network of merchants and service providers, making it widely accepted across various industries. With its popularity and convenience, Clickpay has become a preferred payment method for many online shoppers and businesses.

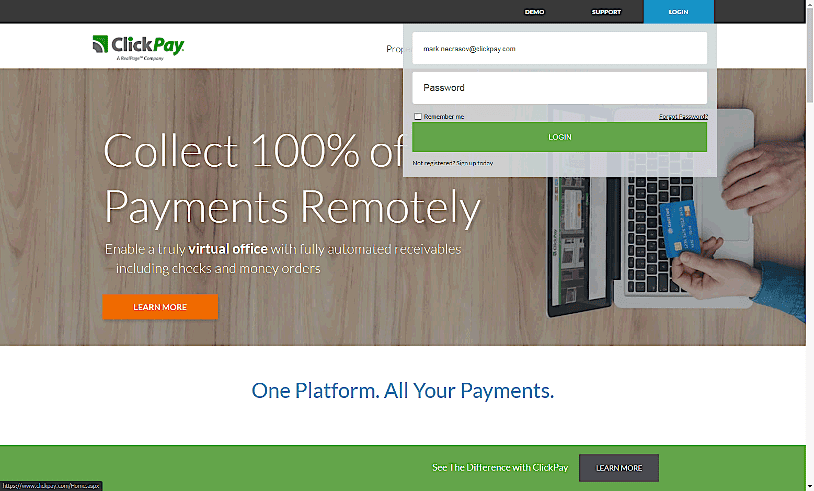

Setting Up Your Clickpay Account: A Step-by-Step Guide

Setting up your Clickpay account is quick and easy. Just follow this step-by-step guide to get started:

- Create an Account: Visit the Clickpay website and click on the “Sign Up” button. Fill in the required information, such as your name, email address, and password. Make sure to choose a strong and secure password to protect your account.

- Verify Your Account: After creating your account, you will receive a verification email. Open the email and click on the verification link to confirm your Clickpay account.

- Link Your Credit Card: To start making payments with Clickpay, you need to link a credit card to your account. Go to the “Payment Methods” section in your Clickpay dashboard and click on “Add Credit Card.” Fill in the necessary details, including your credit card number, expiration date, and CVV code. Click “Save” to complete the process.

- Complete Account Verification: To ensure the security of your Clickpay account, you will need to verify your identity. Follow the instructions provided to upload the required documents, such as a copy of your ID or a utility bill. Once your documents are uploaded, Clickpay will review and verify your account.

- Explore Clickpay: Congratulations! You have successfully set up your Clickpay account. Take some time to familiarize yourself with the features and functionalities of the platform. You can now start making secure and convenient online payments using your Clickpay account.

Setting up your Clickpay account is the first step towards simplifying your online payments. By following this step-by-step guide, you can quickly get started and enjoy the benefits of Clickpay’s secure and user-friendly platform.

The Versatility of Clickpay Across Various Platforms

Clickpay is not just a payment platform limited to one industry or platform. Its versatility allows it to seamlessly integrate with e-commerce websites as well as cater to the unique needs of the service industry. By offering convenient and secure online payment solutions, Clickpay has become a go-to choice for both merchants and customers.

Integration with E-commerce

Clickpay offers effortless integration with e-commerce platforms, making it easy for businesses to incorporate this payment solution into their online stores. Whether you run a small online shop or a large retail website, Clickpay provides a seamless payment experience for both merchants and customers alike.

With Clickpay’s e-commerce integration, businesses can enjoy the following benefits:

- Convenient checkout process: Customers can pay for their purchases quickly and securely with just a few clicks, enhancing the overall shopping experience.

- Wide range of payment options: Clickpay supports various payment methods, including credit cards, debit cards, and digital wallets, ensuring that customers can choose the option that suits them best.

- Secure transactions: Clickpay prioritizes the security of transactions, protecting both customers and merchants from potential risks and fraudulent activities.

With its seamless integration and user-friendly interface, Clickpay enhances the payment experience for both e-commerce businesses and their customers.

Utilizing Clickpay in the Service Industry

Clickpay’s versatility extends beyond e-commerce, making it an ideal payment solution for the service industry as well. Whether you operate a subscription-based business, utility company, or any other service-oriented establishment, Clickpay can streamline your payment processes and provide a convenient solution for both you and your customers.

Here are some key benefits of utilizing Clickpay in the service industry:

- Recurring billing: Clickpay simplifies the collection of recurring payments, allowing service providers to automate the billing process and ensure timely payments from their customers.

- Convenient customer portal: Clickpay provides a user-friendly customer portal where clients can view their billing statements, update their payment information, and access other account-related features, reducing the need for manual intervention.

- Improved cash flow: By offering seamless and secure payment options, Clickpay helps service providers collect payments efficiently, improving their cash flow and reducing the risk of late or missed payments.

Whether it’s managing subscriptions, accepting payments for services rendered, or handling utility bills, Clickpay offers a versatile and reliable solution for the service industry.

| E-commerce Integration | Service Industry |

|---|---|

| Convenient checkout process | Recurring billing |

| Wide range of payment options | Convenient customer portal |

| Secure transactions | Improved cash flow |

Understanding the Security Measures of Clickpay

When it comes to online payments, security is of paramount importance. Clickpay prioritizes the safety and protection of its users’ personal and financial information by implementing robust security measures. With Clickpay, you can rest assured that your transactions are handled with the utmost care and protection.

Data Encryption: Clickpay employs advanced encryption technology to safeguard your sensitive data during transmission. This ensures that your payment information, such as credit card details, is encrypted and cannot be intercepted by unauthorized third parties.

Fraud Prevention: Clickpay has a comprehensive fraud prevention system in place to detect and prevent fraudulent activities. Through advanced algorithms and real-time monitoring, Clickpay identifies suspicious transactions and takes immediate action to protect users from potential fraud.

User Protection: Clickpay prioritizes the protection of its users’ accounts and personal information. Multiple security layers, including strong password requirements and two-factor authentication, safeguard user accounts from unauthorized access.

“At Clickpay, the security and trust of our users is our top priority. We utilize industry-leading security measures to ensure that every transaction is safe and secure.”

| Clickpay Security Measures | Description |

|---|---|

| Data Encryption | Utilizes advanced encryption technology to protect sensitive information during transmission. |

| Fraud Prevention | Implements a sophisticated fraud prevention system to detect and prevent fraudulent activities. |

| User Protection | Safeguards user accounts through strong password requirements and two-factor authentication. |

By understanding and appreciating the security measures implemented by Clickpay, users can confidently make online payments knowing that their information is protected. Clickpay’s commitment to security ensures a safe and secure transaction experience for all users.

How Does Clickpay Work? The User Experience Explained

For users seeking a streamlined and efficient online payment experience, Clickpay offers a user-friendly platform that simplifies the checkout process and provides a seamless user experience. Let’s explore how Clickpay works, and the key features that enhance the user experience.

Streamlining Checkout with Clickpay

Clickpay aims to make the checkout process quick, convenient, and hassle-free for users. By leveraging advanced technology and intuitive design, Clickpay offers the following features to streamline the checkout experience:

- Saved Payment Information: With Clickpay, users can securely save their payment information, eliminating the need to enter it repeatedly for future transactions. This feature enhances convenience and reduces the time required to complete a payment.

- One-Click Payments: Clickpay enables users to make payments with just a single click, minimizing the steps needed to complete a transaction. This feature is especially useful for frequent payments or repeat purchases, providing a quick and effortless checkout experience.

- Seamless Integration with Merchant Websites: Clickpay seamlessly integrates with various merchant websites, allowing users to complete their transactions without being redirected to multiple platforms. This integration ensures a smooth and uninterrupted payment process, enhancing user satisfaction.

Navigating Through the Clickpay Dashboard

The Clickpay dashboard serves as a centralized hub for users to manage their payments, view transaction history, and access other account-related features. It offers a user-friendly interface designed to enhance usability and provide a comprehensive overview of the user’s payments. Here’s how users can navigate through the Clickpay dashboard:

- Logging in: Users can access the Clickpay dashboard by logging into their accounts using their registered credentials. This ensures secure access to their payment information and transaction history.

- Managing Payments: Within the Clickpay dashboard, users can easily manage their payments by initiating new transactions, reviewing pending payments, and scheduling recurring payments. This functionality provides users with full control over their payment activities.

- Viewing Transaction History: The Clickpay dashboard allows users to view their transaction history, providing a detailed record of all completed payments. Users can conveniently access past receipts, track expenses, and reconcile their financial records.

- Accessing Account Settings: Clickpay offers various account-related features, such as profile settings, security settings, and user preferences. Users can effortlessly access these settings within the dashboard, ensuring a personalized and tailored payment experience.

In conclusion, Clickpay is designed to optimize the user experience by streamlining the checkout process and providing a user-friendly dashboard for managing payments. With features such as saved payment information, one-click payments, seamless integration with merchant websites, and intuitive dashboard navigation, Clickpay offers a convenient and efficient payment solution for users across various industries.

Clickpay for Business Owners: Advantages and Case Studies

Clickpay offers numerous advantages for business owners, making it a preferred payment solution for both online and offline transactions. By leveraging the features and benefits of Clickpay, businesses can enhance their payment processes and improve cash flow. Let’s explore the advantages of using Clickpay and learn from real case studies of businesses that have successfully integrated this payment solution.

1. Simplified Payment Processes: Clickpay streamlines payment processes, enabling businesses to accept online payments easily. By providing a user-friendly interface, Clickpay simplifies the checkout experience for customers, leading to higher conversion rates and increased revenue for businesses.

2. Enhanced Convenience: With Clickpay, business owners can offer their customers a convenient payment option that allows them to securely pay with their credit cards. By providing convenient payment solutions, businesses can attract more customers and create a positive shopping experience.

3. Improved Cash Flow: The quick and secure nature of Clickpay’s payment processing system ensures that businesses receive payments promptly. This helps improve cash flow and provides businesses with the liquidity they need to operate and grow.

4. Increased Security: Clickpay prioritizes security, implementing robust encryption and fraud prevention measures to protect both businesses and customers from unauthorized transactions and potential data breaches. This instills trust and confidence in customers, encouraging repeat business.

5. Seamless Integration: Clickpay offers seamless integration with various e-commerce platforms, making it easy for businesses to incorporate this payment solution into their existing websites or online stores. This integration saves time and effort for businesses when setting up their online payment systems.

Now, let’s explore some real case studies of businesses that have successfully implemented Clickpay:

“ABC Clothing Store”

ABC Clothing Store, a well-known retail brand, implemented Clickpay as their online payment solution. By providing customers with a convenient and secure payment option, ABC Clothing Store experienced a significant increase in online sales and customer satisfaction.

“XYZ Service Provider”

XYZ Service Provider, a leading subscription-based business, integrated Clickpay into their billing system. This resulted in a streamlined payment process for their customers, leading to a decrease in late payments and an improvement in cash flow.

- ABC Clothing Store experienced a significant increase in online sales and customer satisfaction.

- XYZ Service Provider saw a decrease in late payments and an improvement in cash flow.

These case studies demonstrate the effectiveness of Clickpay as a versatile payment solution for businesses across different industries. By leveraging the advantages of Clickpay, businesses can optimize their payment processes, improve customer satisfaction, and drive growth.

Can You Pay with Credit Card on Clickpay?

When it comes to online payments, flexibility is key. With Clickpay, you have the freedom to choose from a variety of payment methods, including credit card payments. This section will explore the different payment options available on Clickpay and how you can make the most of them.

Flexibility in Payment Methods

Clickpay understands that everyone has their preferred way of making payments. That’s why they offer a range of payment methods to suit your needs. Whether you prefer using your credit card, debit card, or even mobile wallets like Apple Pay or Google Pay, Clickpay has you covered. By providing multiple options, Clickpay ensures that you can make payments conveniently and securely, no matter your preference.

Additionally, Clickpay’s platform is designed to seamlessly integrate with various payment gateways, allowing you to link your preferred payment method effortlessly. This means that if you have a preferred credit card that you use for online transactions, you can easily link it to your Clickpay account and enjoy a smooth payment experience.

The Benefits of Credit Card Payments with Clickpay

Using a credit card for payments on Clickpay comes with a host of benefits. First and foremost, credit cards offer enhanced security. With advanced encryption technology and robust fraud detection measures, Clickpay ensures that your credit card information is protected throughout the payment process. This added layer of security gives you peace of mind when making online transactions.

In addition to security, credit card payments offer convenience. By using your credit card, you can complete transactions quickly and easily, avoiding the hassle of entering payment details manually. With just a few clicks, you can finalize your purchase and get back to what matters most to you.

Furthermore, credit card payments often come with rewards or cashback programs. By using your credit card on Clickpay, you may have the opportunity to earn rewards points or cashback on your purchases. This means that every time you make a payment, you can enjoy additional benefits and savings.

So, whether you prefer the convenience, security, or added rewards, using a credit card for payments on Clickpay offers numerous advantages. Embrace the flexibility and benefits that credit card payments provide and make your online transactions a breeze.

Maximizing Rewards and Benefits Through Clickpay

Clickpay offers users the opportunity to earn various rewards and benefits while using the platform for their transactions. By taking advantage of these features, users can enhance their Clickpay experience and get even more value from their payments.

Earning Cashback and Points with Clickpay

One of the key perks of using Clickpay is the ability to earn cashback and loyalty points on transactions. Every time users make a payment through Clickpay, they have the chance to earn rewards that can be redeemed for discounts or other exclusive benefits.

To maximize cashback and points earnings with Clickpay, keep the following tips in mind:

- Take advantage of promotions and special offers: Clickpay frequently offers promotions where users can earn higher cashback rates or bonus loyalty points. Keep an eye out for these opportunities to boost your rewards.

- Shop through Clickpay’s partner merchants: Clickpay has partnered with a wide range of retailers and service providers, offering special cashback rates or additional loyalty points on purchases made through these partners. By shopping with these merchants, you can maximize your rewards.

- Use Clickpay consistently: The more you use Clickpay for your transactions, the more opportunities you have to earn rewards. Make it a habit to use Clickpay whenever possible to accumulate cashback and points over time.

Partner Offers and Clickpay Exclusives

Clickpay has established partnerships with various merchants and service providers, offering users exclusive deals and benefits. These partner offers can provide additional value and savings beyond the standard rewards program.

| Partner | Offer |

|---|---|

| ABC Retail | 10% off on all purchases made with Clickpay |

| XYZ Travel | Exclusive vacation packages with discounted rates for Clickpay users |

| 123 Dining | Free appetizer with every Clickpay payment |

These are just a few examples of the partner offers available through Clickpay. By exploring the partner network and taking advantage of these exclusive deals, users can enjoy additional benefits and savings on their purchases.

Whether it’s earning cashback, collecting loyalty points, or accessing exclusive partner offers, Clickpay rewards users for their loyalty and provides a range of benefits. By making the most of these features, users can maximize the value of their payments and enhance their overall Clickpay experience.

Comparison: Clickpay Vs. Other Payment Methods

When it comes to choosing an online payment method, convenience and speed are essential factors to consider. In this section, we will compare Clickpay with other payment methods to help you make an informed decision.

Convenience and Speed: How Clickpay Stacks Up

Clickpay shines in terms of convenience and speed, making it an ideal choice for hassle-free transactions. With Clickpay, users can enjoy a streamlined payment process that saves time and effort. Unlike traditional methods like cash or checks, Clickpay allows you to make payments with just a few clicks, eliminating the need for physical transactions or manual paperwork. Whether you’re paying bills or making online purchases, Clickpay offers a seamless experience that puts convenience at the forefront.

Comparing Transaction Fees and Costs

While Clickpay provides a convenient solution for online payments, it’s important to consider transaction fees and costs. Like other payment methods, Clickpay may have associated fees. To help you make an informed decision, let’s compare Clickpay’s fees with other payment methods:

| Payment Method | Transaction Fees |

|---|---|

| Clickpay | Competitive rates |

| Payment Method A | High fees |

| Payment Method B | Costly transaction charges |

| Payment Method C | Expensive fees |

As you can see, Clickpay offers competitive rates in comparison to other payment methods. It allows you to enjoy the convenience and speed of online payments without incurring excessive fees. By choosing Clickpay, you can make your transactions cost-effective while still enjoying the benefits of a user-friendly and secure platform.

Conclusion

In conclusion, Clickpay provides a secure and convenient solution for online payments, empowering users to streamline their transactions with ease. With its user-friendly interface and versatile features, Clickpay simplifies the payment process for individuals and businesses alike.

By embracing Clickpay, users can revolutionize the way they make online payments, benefiting from a seamless and efficient solution. With Clickpay’s extensive network of trusted merchants, users can enjoy the convenience of making secure transactions using their credit cards.

Clickpay’s commitment to security ensures that users can make online transactions with confidence. With its robust measures in place, including data encryption and fraud prevention, Clickpay offers a secure platform for conducting online payments.

Whether it’s for bill payments or online purchases, Clickpay emerges as a reliable and convenient option for all types of online transactions. With Clickpay, users can experience the ease of making payments while enjoying the peace of mind that comes with knowing their transactions are secure.

FAQ

What is Clickpay?

Clickpay is an innovative online payment platform that simplifies the process of making payments for individuals and businesses. It allows users to securely make payments using their credit cards, providing a convenient solution for bill payments and online purchases.

How does Clickpay work?

Clickpay works by allowing users to make quick and secure payments using their credit cards. Users can simply link their credit card to their Clickpay account and then proceed to make payments with just a few clicks. Clickpay streamlines the checkout process, making it convenient and hassle-free.

Can I pay with a credit card on Clickpay?

Yes, Clickpay accepts credit card payments. It offers flexibility in payment methods, including credit cards, allowing users to choose the payment option that suits their needs.

How secure is Clickpay?

Clickpay has implemented stringent security measures to ensure safe and secure transactions. It uses data encryption to protect user information and has fraud prevention mechanisms in place. Users can have peace of mind knowing that their payment details are protected when using Clickpay.

How do I set up a Clickpay account?

Setting up a Clickpay account is easy. You can follow a step-by-step guide that includes the registration process, account verification, and linking your credit card to your Clickpay account. By following the guide, you can create your Clickpay account and start using the platform for your payment needs.